“It’s a business. If I could make more money down in the zinc mines, I’d be mining zinc.”

“It’s a business. If I could make more money down in the zinc mines, I’d be mining zinc.”

(Roger Maris[1])

I originally planned to write this post to answer the question, what is a Bitcoin? However, after three days of research, I decided to do more and became a Bitcoin miner and I want to share with you all why and how. But first, I’ll try answering the question.

Bitcoin is a decentralized, user-administrated and self-governing payment system. Think of it as a virtual currency. So rather than transactions being recorded and stored on a single, privately held ledger, they are recorded in a public distributed ledger[2]. And in lieu of transactions being administered by a traditional financial institution, they take place between users directly, without an intermediary[3]. As well rather than a government institution authorizing and controlling the currency, Bitcoin is a self-governing, peer-to-peer network of computers running specialized software that makes sure the system is accurate. I like to think of it as alternative, ‘Internet’ money.

[Tweet “Bitcoin is a decentralized, user-administrated and self-governing payment system. “]

Getting Bitcoins

There are three ways to get bitcoins: The first is to accept them in return for products or services, the second is to buy them and the third is to mine them. I’m not interested in the first route at this point, but the second and third ways caught my attention. Here are my thoughts about buying bitcoins.

Bitcoin was launched in 2009 after the financial collapse that rocked the entire world. The creators set a limit of 21 million bitcoins as the maximum number that could ever be in the system. They also created a program that automatically decreases the number of bitcoins entering the system by 50% approximately every four years. To date, there are about 16 million bitcoins in circulation. It made sense to me that establishing a diminishing supply of bitcoins and setting a finite maximum would create an upward pull in its value overtime.

Here’s what has happened so far…

At the start, a single bitcoin had virtually no value. By the end of 2011, one bitcoin was worth $4.38. A year later it had reached $13.41… by 2013, a bitcoin could be traded for $817.12. Then the virtual currency market in general and Bitcoin in particular encountered multiple scandals, intense government interventions and self-inflicted wounds[4]. Its value dropped precipitously to $302.00 by the end of 2014 and since then, it has been on a steady march back up. With year-end 2015 it was $429.78… at year-end 2016, a whooping $958.24… and on March 2, 2017, the value of one bitcoin topped the price of an ounce of gold for the first time at $1,256.58.

Buying Bitcoins

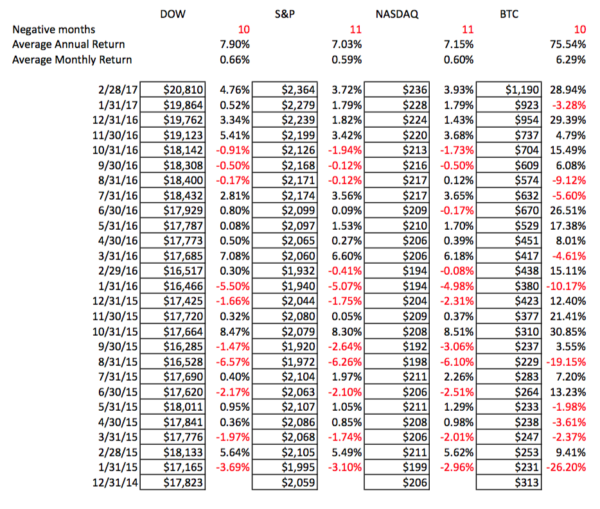

Part one of my Bitcoin investment strategy is to shift some money from stock market investments and buy Bitcoins based on its average annual return of 75.54% for the last twenty-six months. We can compare that to the financial market annual returns of 7.90% for the Dow Jones Industrial Average, 7.03% for the S&P 500 and 7.15% for the NASDAQ Composite over the same time period.

Mining Bitcoins

If you’re not familiar with Bitcoin mining, watch this 2-minute video. I’ve discovered there are also three ways to become a bitcoin miner. The first is to buy software, specialized equipment and configure my computers to mine on my own. The second is to join forces with other miners in a Bitcoin mining pool[5]. I’ve chosen the third way for now so I’ve purchased a contract with a Mining Company.

I have started small, really small. I invested $300 and received a 3% discount for using an affiliate code (EKUqa0). So for $291, I own a little piece of a mining facility that specializes in finding bitcoins. A Bitcoin calculator said I could expect to earn $1.46 per day from my investment. That would create an income of $43 per month and over $500 per year. After just a few days though, my actual payouts averaged only $0.87 per day but this would still generate an annual income of $319, or an amazing 109% annual return on investment.

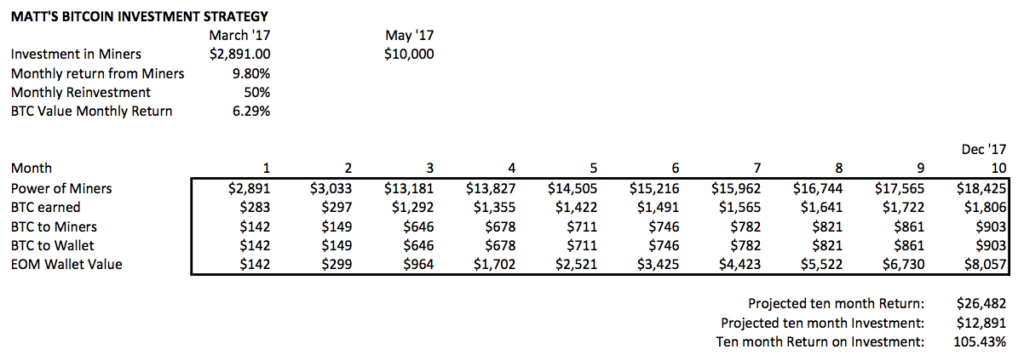

I still have much to learn but I am excited about the next steps of my strategy. I’ll invest another $2600 increasing the value my contract to $2,891 – see Power of Miners in Month 1. That means I’ll own a little larger piece of the mining facility. That investment should generate $283 in the first month – see BTC earned – based on my $0.87 test. I’ll then reinvest half of my monthly earnings or $142.50 – see BTC to Miners. Each month I’ll be adding additional value to my contract and thereby continuously increasing the Power of Miners. I’ll transfer the remaining half of my monthly earnings to a Bitcoin Wallet[6] for safekeeping – see BTC to Wallet, and hopefully this will appreciate in value too – see EOM Wallet Value. If I am pleased with how everything is working after 60 days, I’ll invest another $10,000 in May. That would increase my Power of Miners to $13,181 and my monthly BTC earned to an estimated $1,292.

As you can see, if this plan works according to my calculations, at the end of this year, I’ll have a mining contract valued at $18,425, ($5,524 more than my actual investment). And bitcoins in my wallet worth more than $8,000, so if it all continues to work like that, I’ll be doubling down in 2018.

Stay tuned for updates…

[1] https://en.wikipedia.org/wiki/Roger_Maris

[2] https://en.wikipedia.org/wiki/Bitcoin

[3] https://en.wikipedia.org/wiki/Bitcoin#cite_note-primer-18

[4] https://www.youtube.com/watch?v=tmxqlSevtkQ

[5] https://www.bitcoinmining.com/bitcoin-mining-pools/

Image via Unsplash | This post may contain affiliate links, which means if you click and then purchase we will receive a small commission (at no additional cost to you). Thank you for reading & supporting Happy Living!